Get the free 2013 rhode island amended

Show details

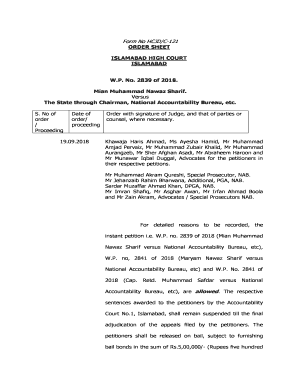

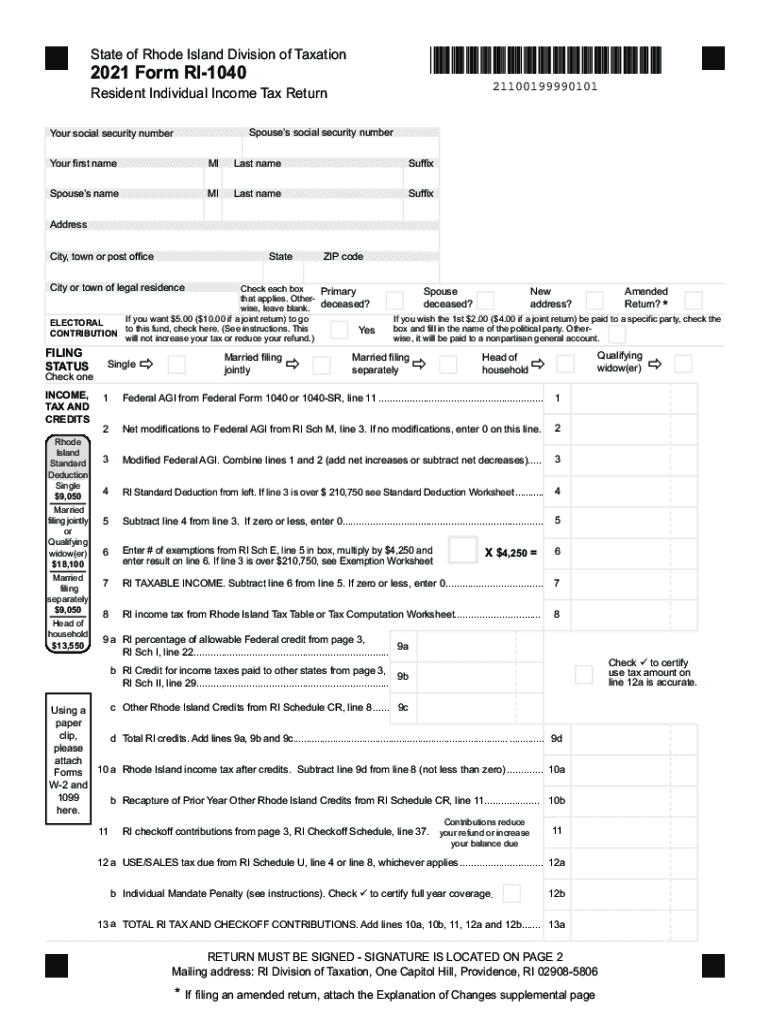

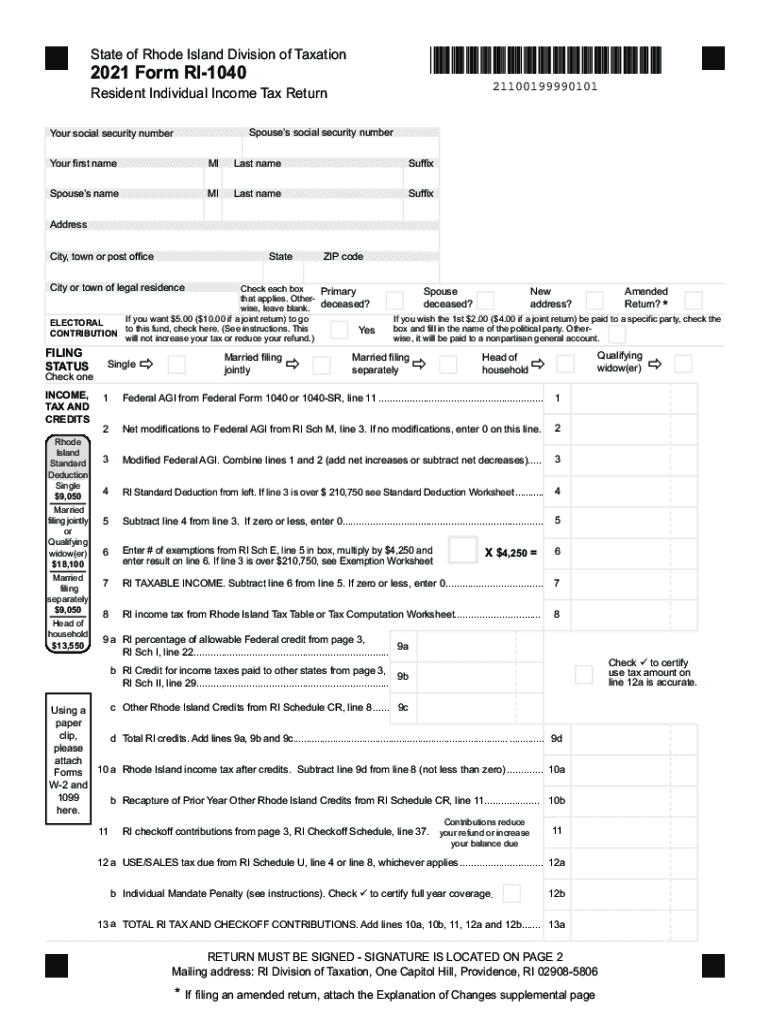

37 Federal earned income credit from Federal Form 1040 or 1040-SR line 27a.. 38 Rhode Island percentage. Otherwise it will be paid to a nonpartisan general account. Federal AGI from Federal Form 1040 or 1040-SR line 11. Your signature Your driver s license number and state Date Telephone number Spouse s signature Paid preparer signature Paid preparer address Spouse s driver s license number and state Print name PTIN May the Division of Taxation contact your preparer YES Revised 12/2021 RI...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 ri1040x nr itr form

Edit your 2013 rhode island amended form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 rhode island amended form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013 rhode island amended online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2013 rhode island amended. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 rhode island amended

How to fill out Rhode Island amended:

01

Obtain the correct form: Start by locating the Rhode Island amended form specifically designed for the purpose you are amending (e.g., income tax, sales tax, etc.).

02

Review the instructions: Carefully read the instructions provided with the form, ensuring you understand the requirements and steps involved in completing the amendment.

03

Gather necessary information: Collect all relevant documents and information needed to accurately complete the amended form. This may include previous tax returns, supporting documentation, receipts, and any other relevant records needed to make the necessary changes.

04

Identify changes: Clearly indicate the changes you are making on the amended form. This may be adjusting figures, adding or removing information, or correcting errors. Be sure to use the appropriate sections or fields provided on the form.

05

Provide explanations: If necessary, provide a clear and concise explanation for the changes made on the amended form. This helps the Rhode Island Department of Revenue understand the rationale and purpose behind the amendments.

06

Calculate adjustments: If making any financial adjustments, perform the necessary calculations accurately to ensure the amended form reflects the corrected amounts. Double-check all calculations to avoid potential mistakes.

07

Attach supporting documents: Include any required supporting documents that validate the changes made on the amended form. This may include receipts, invoices, or any other relevant paperwork that substantiates the corrections.

08

Sign and date the form: After completing the necessary sections of the amended form, sign and date it. If applicable, ensure any preparer or representative also signs accordingly.

Who needs Rhode Island amended:

01

Individuals: If you are an individual taxpayer in Rhode Island and need to correct errors or make changes on your previously filed tax forms, you may need to file a Rhode Island amended form.

02

Businesses: Business entities operating in Rhode Island may also need to file an amended form if they need to correct or update any previously filed information, such as sales tax or corporate income tax filings.

03

Non-residents: Non-residents with Rhode Island-sourced income who filed a non-resident tax return and need to make corrections or adjustments may also require the Rhode Island amended form.

Fill

form

: Try Risk Free

People Also Ask about

How much is tax in usa?

The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you're one of the lucky few to earn enough to fall into the 37% bracket, that doesn't mean that the entirety of your taxable income will be subject to a 37% tax. Instead, 37% is your top marginal tax rate.

What are the 4 main taxes?

Types of Taxes Income tax: This tax stems from revenue earned through a job or a personal venture. Payroll tax: This tax is deducted from an employee's paycheck. Capital gains tax. Estate tax: This tax is imposed after an individual dies and their property is transferred to a living person.

Will I get a bigger tax refund in 2023?

(WWLP/Nexstar) — Taxpayers may need to prepare for smaller tax refunds in 2023. ing to the Internal Revenue Service, refunds could be smaller because taxpayers didn't receive stimulus payments this tax year.

How much is tax in usa 2022?

When it comes to federal income tax rates and brackets, the tax rates themselves aren't changing from 2022 to 2023. The same seven tax rates in effect for the 2022 tax year – 10%, 12%, 22%, 24%, 32%, 35% and 37% – still apply for 2023.

What is the purpose of tax?

The main purpose of taxation is to raise revenue for the services and income supports the community needs. Public revenues should be adequate for that purpose.

How early can you file taxes 2022?

Even though taxes for most are due by April 18, 2022, you can e-file (electronically file) your taxes earlier. The IRS likely will begin accepting electronic returns anywhere between Jan. 15 and Feb. 1, 2022, when taxpayers should have received their last paychecks of the 2021 fiscal year.

When can I file my taxes 2023?

The filing deadline for the regular tax season will be April 18th, 2023 given that the normal April 15th deadline falls on the weekend and the Emancipation day holiday (April 17th) in DC. Approved extension filings will be due by October 18th, 2023.

What are the 4 types of taxes?

Types of Taxes Income tax: This tax stems from revenue earned through a job or a personal venture. Payroll tax: This tax is deducted from an employee's paycheck. Capital gains tax. Estate tax: This tax is imposed after an individual dies and their property is transferred to a living person.

What are the 5 taxes?

In fact, when every tax is tallied – federal, state and local income tax (corporate and individual); property tax; Social Security tax; sales tax; excise tax; and others – Americans spend 29.2 percent of our income in taxes each year.

What are 5 different types of tax?

In fact, when every tax is tallied – federal, state and local income tax (corporate and individual); property tax; Social Security tax; sales tax; excise tax; and others – Americans spend 29.2 percent of our income in taxes each year.

What are 5 taxes in the US?

Here are seven ways Americans pay taxes. Income taxes. Income taxes can be charged at the federal, state and local levels. Sales taxes. Sales taxes are taxes on goods and services purchased. Excise taxes. Payroll taxes. Property taxes. Estate taxes. Gift taxes.

How much taxes do you pay on $10000?

If you make $10,000 a year living in the region of California, USA, you will be taxed $875. That means that your net pay will be $9,125 per year, or $760 per month.

What are the 5 taxes in the Philippines?

List of Taxes in the Philippines Philippines Capital Gains Tax. Philippines Documentary Stamp Tax. Philippines Donor's Tax. Philippines Estate Tax. Philippines Income Tax. Philippines Percentage Tax. Philippines Value Added Tax (VAT) Philippines Withholding Tax on Compensation.

What is tax and how does it work?

Taxation refers to the fees and financial obligations imposed by a government on its residents. Income taxes are paid in almost all countries around the world. However, taxation applies to all payments of mandatory levies, including on income, corporate, property, capital gains, sales, and inheritance.

When can I file my taxes for 2022 in 2023?

Generally, most individuals are calendar year filers. For individuals, the last day to file your 2022 taxes without an extension is April 18, 2023, unless extended because of a state holiday.

What do taxes mean?

Taxes are mandatory contributions levied on individuals or corporations by a government entity—whether local, regional, or national. Tax revenues finance government activities, including public works and services such as roads and schools, or programs such as Social Security and Medicare.

What does taxes mean in simple words?

: an amount of money that a government requires people to pay ing to their income, the value of their property, etc., and that is used to pay for the things done by the government.

How much taxes do I pay on $7000?

If you make $7,000 a year living in the region of California, USA, you will be taxed $613. That means that your net pay will be $6,388 per year, or $532 per month.

How much salary is tax free in USA?

Do I Need to File Taxes? Not everyone is required to file or pay taxes. Depending on your age, filing status, and dependents, for the 2022 tax year, the gross income threshold for filing taxes is between $12,550 and $28,500.

How do I file my 2022 2023 tax return?

STEP1: -Visit the official Income Tax e-filing portal. STEP2: -Register or login to e-file your returns. STEP3: -Navigate to e-file and then click 'File Income Tax Return' once you have logged in to the portal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2013 rhode island amended from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like 2013 rhode island amended, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I edit 2013 rhode island amended on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing 2013 rhode island amended right away.

How do I fill out 2013 rhode island amended using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign 2013 rhode island amended and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is ri tax amended?

RI tax amended refers to a revised tax return filed in Rhode Island to correct or update previously submitted tax information.

Who is required to file ri tax amended?

Individuals and businesses that have made errors or need to update their tax return for the state of Rhode Island are required to file a RI tax amended.

How to fill out ri tax amended?

To fill out a RI tax amended, obtain the correct form from the Rhode Island Division of Taxation website, provide the corrected information and details of the changes, and submit it as per the guidelines.

What is the purpose of ri tax amended?

The purpose of a RI tax amended is to correct inaccuracies in a previously filed tax return, ensuring that the tax records are accurate and comply with state tax laws.

What information must be reported on ri tax amended?

The information that must be reported includes the original return details, the corrected amounts, explanations for the changes, and any other pertinent financial information.

Fill out your 2013 rhode island amended online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Rhode Island Amended is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.