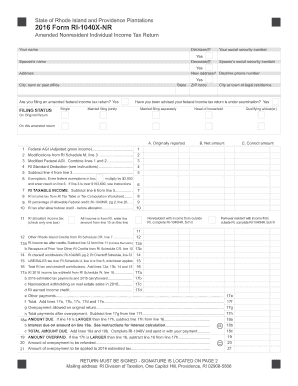

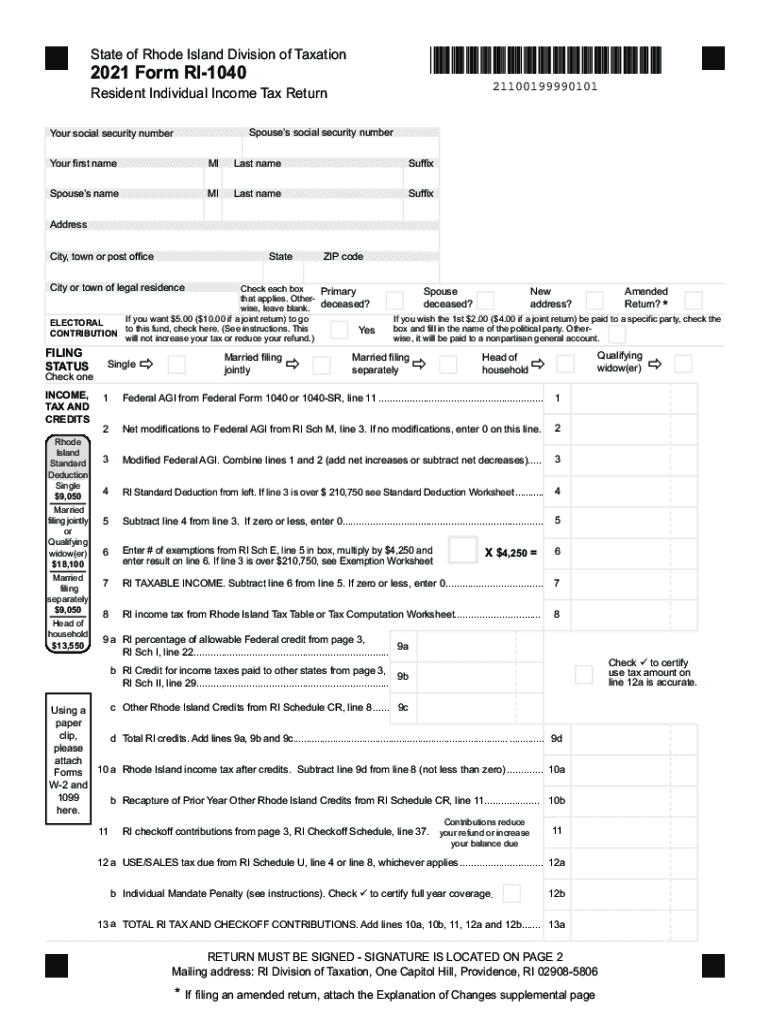

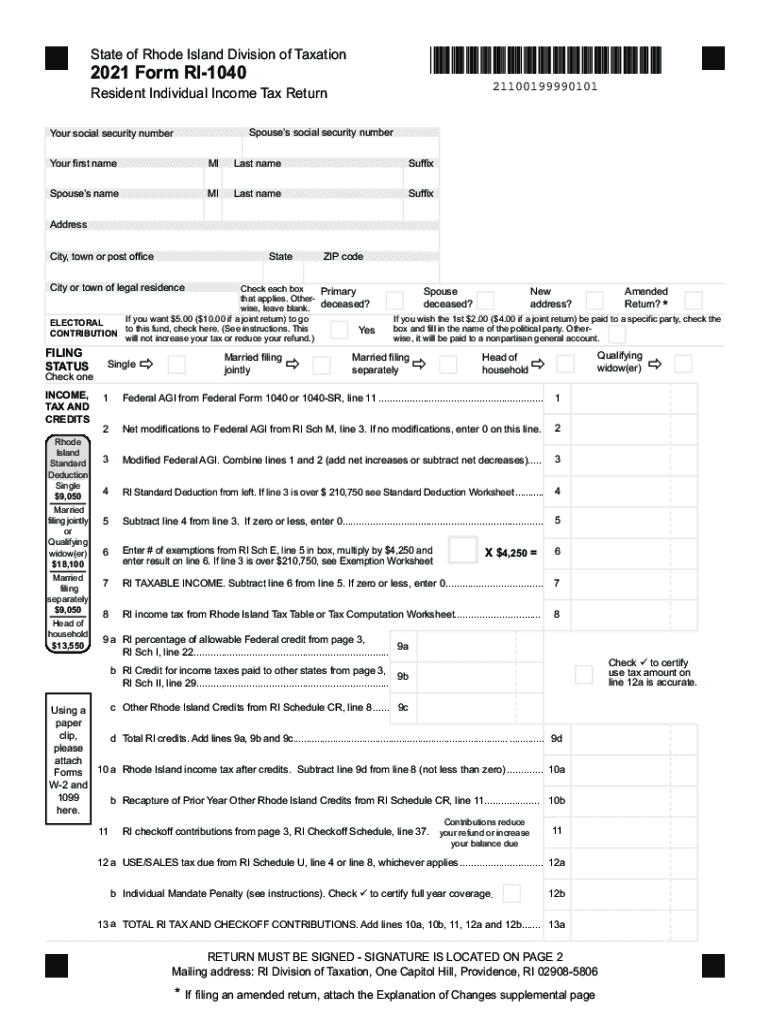

RI DoT RI-1040X-NR 2021-2024 free printable template

Show details

37 Federal earned income credit from Federal Form 1040 or 1040-SR line 27a.. 38 Rhode Island percentage. Otherwise it will be paid to a nonpartisan general account. Federal AGI from Federal Form 1040 or 1040-SR line 11. Your signature Your driver s license number and state Date Telephone number Spouse s signature Paid preparer signature Paid preparer address Spouse s driver s license number and state Print name PTIN May the Division of Taxation contact your preparer YES Revised 12/2021 RI...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your rhode island ri 2021-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rhode island ri 2021-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rhode island ri online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rhode island amended form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

RI DoT RI-1040X-NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rhode island ri 2021-2024

How to fill out Rhode Island amended:

01

Obtain the correct form: Start by locating the Rhode Island amended form specifically designed for the purpose you are amending (e.g., income tax, sales tax, etc.).

02

Review the instructions: Carefully read the instructions provided with the form, ensuring you understand the requirements and steps involved in completing the amendment.

03

Gather necessary information: Collect all relevant documents and information needed to accurately complete the amended form. This may include previous tax returns, supporting documentation, receipts, and any other relevant records needed to make the necessary changes.

04

Identify changes: Clearly indicate the changes you are making on the amended form. This may be adjusting figures, adding or removing information, or correcting errors. Be sure to use the appropriate sections or fields provided on the form.

05

Provide explanations: If necessary, provide a clear and concise explanation for the changes made on the amended form. This helps the Rhode Island Department of Revenue understand the rationale and purpose behind the amendments.

06

Calculate adjustments: If making any financial adjustments, perform the necessary calculations accurately to ensure the amended form reflects the corrected amounts. Double-check all calculations to avoid potential mistakes.

07

Attach supporting documents: Include any required supporting documents that validate the changes made on the amended form. This may include receipts, invoices, or any other relevant paperwork that substantiates the corrections.

08

Sign and date the form: After completing the necessary sections of the amended form, sign and date it. If applicable, ensure any preparer or representative also signs accordingly.

Who needs Rhode Island amended:

01

Individuals: If you are an individual taxpayer in Rhode Island and need to correct errors or make changes on your previously filed tax forms, you may need to file a Rhode Island amended form.

02

Businesses: Business entities operating in Rhode Island may also need to file an amended form if they need to correct or update any previously filed information, such as sales tax or corporate income tax filings.

03

Non-residents: Non-residents with Rhode Island-sourced income who filed a non-resident tax return and need to make corrections or adjustments may also require the Rhode Island amended form.

Video instructions and help with filling out and completing rhode island ri

Instructions and Help about tax federal form

Fill tax form ri : Try Risk Free

People Also Ask about rhode island ri

How much is tax in usa?

What are the 4 main taxes?

Will I get a bigger tax refund in 2023?

How much is tax in usa 2022?

What is the purpose of tax?

How early can you file taxes 2022?

When can I file my taxes 2023?

What are the 4 types of taxes?

What are the 5 taxes?

What are 5 different types of tax?

What are 5 taxes in the US?

How much taxes do you pay on $10000?

What are the 5 taxes in the Philippines?

What is tax and how does it work?

When can I file my taxes for 2022 in 2023?

What do taxes mean?

What does taxes mean in simple words?

How much taxes do I pay on $7000?

How much salary is tax free in USA?

How do I file my 2022 2023 tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rhode island amended?

It is unclear what specific amendment is being referred to in the question. Rhode Island has made various amendments to its laws and constitution over time. Some significant amendments include amendments to the state constitution to guarantee equal rights for women, amendments related to voting and elections, and amendments related to taxation and budgetary issues. It would be helpful to provide more details or context to provide a more specific answer.

Who is required to file rhode island amended?

Individuals who need to correct errors or provide additional information on their previously filed Rhode Island tax return are required to file an amended return. This includes both Rhode Island residents and nonresidents who have filed a state tax return with incorrect or incomplete information.

How to fill out rhode island amended?

To fill out a Rhode Island amended tax return (Form RI-1040X), follow these steps:

1. Obtain a copy of the original tax return: Gather your previously filed Rhode Island tax return (Form RI-1040) and any supporting documentation.

2. Download the amended form: Go to the Rhode Island Division of Taxation website or search for "Rhode Island amended tax return form" to find the latest version of Form RI-1040X. Download and print the form.

3. Provide personal information: Fill in your name, Social Security Number, address, and filing status. If you are filing a joint amended return, provide the same information for your spouse.

4. Explain the changes: In Part 1, explain the changes you are making on your amended return and the reasons for the changes. Be specific and detailed about the changes you are making.

5. Complete the revised tax calculation: In Part 2, calculate your revised adjusted gross income (AGI), deductions, exemptions, and taxable income based on the changes you provided.

6. Complete the amended tax liability section: In Part 3, calculate your revised tax liability for the year, including any additional taxes owed or the refund amount requested. If you owe additional tax, make sure to include payment with your amended return.

7. Attach supporting documentation: Include any necessary supporting documents, such as W-2 forms, schedules, or other forms that are affected by the changes you are making. Make sure to enclose copies, not originals.

8. Sign and date the form: In Part 4, both you and your spouse (if applicable) must sign and date the amended return.

9. Mail the amended return: Send the completed Form RI-1040X, along with any supporting documents, to the Rhode Island Division of Taxation. The address is usually listed on the form or instructions, but you can also check the division's website for the most up-to-date mailing address.

Remember to keep a copy of the completed amended return, supporting documentation, and any payment made for your records.

It is recommended to consult a tax professional or the Rhode Island Division of Taxation for personalized guidance and assistance with your specific situation.

What is the purpose of rhode island amended?

The purpose of Rhode Island Amended is not clear. Please provide more context or specify what you are referring to so that I can assist you better.

What information must be reported on rhode island amended?

When filing an amended tax return in Rhode Island, the following information must be reported:

1. Basic Information: Provide your name, address, Social Security number, and filing status (single, married filing jointly, etc.).

2. Original Return Information: Include the specific details of your original tax return, such as the year being amended, the original filing status, income reported, deductions/credits claimed, and tax paid.

3. Explanation for Amendment: Clearly state the reason for the amendment and provide a detailed explanation of what changes are being made. This could include reporting additional income, correcting errors, claiming missed deductions/credits, or updating information.

4. Supporting Documentation: Attach all necessary supporting documentation that validates the changes made on the amended return. This may include W-2 forms, 1099 forms, receipts, or other relevant documents.

5. Signature: You must sign and date the amended return to certify the accuracy of the information provided.

Note: You should also make sure to use the correct amended tax form for Rhode Island, which is typically Form RI-1040X for individual income tax returns.

What is the penalty for the late filing of rhode island amended?

The penalty for the late filing of Rhode Island amended returns is 1% of the tax due for each month or partial month the return is late, up to a maximum penalty of 25% of the tax due. Additionally, interest is charged on the unpaid tax at a rate of 12% per year (1% per month) from the original due date until the tax is paid in full.

How can I edit rhode island ri from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like rhode island amended form, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I edit tax form rhode on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing tax taxes right away.

How do I fill out tax calculate calculator using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign taxes state tax form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your rhode island ri 2021-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Form Rhode is not the form you're looking for?Search for another form here.

Keywords relevant to tax state form

Related to taxes tax

If you believe that this page should be taken down, please follow our DMCA take down process

here

.